GIGANTISME and MONOPOLIES

Small is beautiful while over-consolidation is dangerous. And corrupt.

Small is Beautiful, monopolies are bad : they create situations like food crises and inflation.

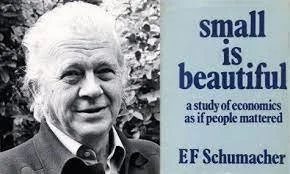

“Small is beautiful” was the title of an important book written in 1973 by economist Ernest Schumacher. Even more instructive was the sub-title: “A study of Economics as if People Really Matter.” There have been many, many editions.

Ernst Friedrich Schumacher (1911 –1977) was a German-British statistician and economist who pushed for human-scale, decentralized and appropriate technologies. While working as Chief Economic Advisor to the British National Coal Board, he founded in 1966 the Intermediate Technology Development Group (now known as Practical Action).

In 1955, while visiting Burma (Myanmar) as an adviser, Schumacher developed principles he called Buddhist economics, based on the belief that individuals need good work for proper human development. "Production from local resources for local needs is the most rational way of economic life," he wrote, refuting the Millennium’s dependence on trans-national monopolies, globalization and millions of containers traveling the oceans. Our new emphasis “short journeys” and “local produce” reflects his prescience.

We live in a world that took the exact opposite route. Big operators are encouraged to swallow their rivals: this concentration of economic power being facilitated by the venal politicians that the corporations finance. Corporate consolidation has led to obscene concentrations of power: the NYT reports that in early 2022, the four biggest IT giants have “lost” more than $3 trillion in value equivalent to the entire GDP of the United Kingdom.

The world’s richest man Elon Musk (last year it was Jeff Besos, but who is counting the billions?) has just offered 44 billion dollars in cash (or perhaps he has not) to purchase Twitter (or probably he will not). Should anyone be allowed to amass such wealth and power?

Prime Minister of the Fat Cats and Tory Oligarchs ?

Britain’s new PM is Liz Truss, and almost her first act after burying Her Majesty The Queen, has been to announce that she will remove the cap on bankers’ bonuses: so while there is a cost-of-living crisis in UK, a climate crisis world-wide, food shortages throughout the Global South, and a war in Ukraine, the Conservative Party in England thinks the most important thing is to make rich men richer.

Here is the opinion of Steve Bell, the Guardian’s cartoonist. He is not a fan of Truss Economics.

I say “the Conservative Party in England” because the bankers live there: neither Scotland nor Wales votes for the Conservatives. I say ‘men’ because that is what most bankers are: few women run banks. Banks are dominated by rich, fat, White Men. Now they will be richer and fatter.

If Liz Truss believes in “trickle down” theory, she must be more stupid that I took her to be. Even George H.W. Bush didn’t believe in it, even though he allowed “trickle down” to continue and helped create the vast inequalities of wealth we see today in USA. Bush called it “voodoo economics” and he was right.

So I conclude that Truss is influenced more by Conservative Party finances, than by British Government finances. Fat Cat Bankers are major contributors to the Tory Party. So are Russian oligarchs: £2 million sterling is what the oligarchs are rumoured to have given Boris (leveraged by his equally venal Party Chairman Ben Elliot) for Conservative Party elections. Is it true that Boris was paid £160,000 to play tennis with an Oligarch’s wife? How sordid ! And how much was Boris paid to approve a peerage – against the advice of the Security Services - for the son of KGB official Lebedev? Lord Lebedev of Siberia? This is Music Hall.

Under the Tories London has become the money-laundering capital of the world.

See this Facebook link https://www.facebook.com/ledbydonkeys/videos/ac-12-on-boris-johnson-and-russian-oligarchs/1793874384143775/ WELL WORTH WATCHING !

"I'm interested in one thing and one thing only and that's bent prime ministers."

This Facebook documentary is a very powerful indictment of the British political way of doing things, and they always do it with impunity.

U.S. Anti-Trust legislation is a tragic loss

I have been a life-long promoter of the Ernest Schumacher philosophy. As a economics student in Scotland, I was brought up with the Monopolies Commission in the UK and the Gold Standard Anti-Trust legislation in the USA which protected consumers and avoided the overweening concentration of power that the United States had witnessed and then attacked with the over-powerful Bell Corporation (broken up into “Baby Bells”) or J.P. Morgan (died 1913) whose banking corporation seemed to own or control most of America.

Ronald Reagan, George H.W. Bush and their multi-millionaire backers destroyed the anti-Trust legislation. John Maynard Keynes - the Cambridge economist of full employment - was replaced by Milton Friedman, the Chicago economist of unbridled greed. Unregulated self-interest became an American economic cancer that spread worldwide. It spread to the US Supreme Court: their decision called “Citizens United” is a legal charter for corporate corruption.

Elected politicians now answered to unelected corporate moguls, and their money. The Keynesian ideals of Ernest Schumacher were swept aside, and the result was huge scandals like Enron and Worldcom; the 2008 subprime financial crisis and the collapse of Lehman Brothers; and the unbridled rise of Microsoft + the GAFAs: Google, Amazon, Facebook, Apple ….

Wikipedia illustration of the term “USA Anti-Trust laws.”

As the world faces a food crisis with famines around the world, it appears that the problem is not simply that the world’s two main wheat exporters Russia and Ukraine are at war, while India (No 3) has stopped all exports of wheat. David Beasley, the executive director of the World Food Programme says: “Right now, Ukraine’s grain silos are full. At the same time, 44 million people around the world are marching towards starvation.” A humanitarian catastrophe threatens.

The underlying food structures seem to make the situation worse. The Guardian’s insightful columnist George Monbiot writes that crops have become too few and too consolidated. Farming is now so concentrated that 60% of calories grown by farmers are wheat, rice, maize and soy ; while just four corporations control something like 90% of the international grain trade. With so little diversity and such gigantic concentrations of grain-power, Monbiot’s article is called “The Banks collapsed in 2008 – our food trade could go the same way.”

What happened to oats and rye, barley and millet, bulgur and sesame and cassava …. ? Why are traditional and local staple crops being neglected?

Small is Beautiful.

Unbridled concentrations of wealth and power transformed “economics – the art of making things” into “financial speculation” and simple capital accumulation: epitomized by Jack Welch at G.E., by the WorldCom and Enron bankruptcies, and by the demise of Arthur Anderson, the international auditing firm that drowned in a bog of connivance and corruption. The collapse of Lehman Brothers and the 2008 financial meltdown resulted from the very same system. When will the next crisis be provoked by “too big to fail” consolidation?

Politicians are paid by banks to look away while corporate cliques steer wealth into their own pockets. Or venal prime ministers encourage wealth storing.

Big-Is-Best consolidations of corporate power have brought the political corruption that plagues America and Western Europe – as well as the oligarchs of Russia. And now we have Elon Musk.

But Small is Beautiful.

from New Food Magazine: a lovely image for an unlovely crisis